The allure of cryptocurrency mining, particularly within the Kaspa ecosystem, is undeniable. Visions of passive income streams and technological innovation dance in the heads of potential miners. But before diving headfirst into the digital gold rush, a crucial question demands an answer: which mining hardware is the *right* hardware for *you*? Selecting the appropriate Kaspa mining rig is not a simple task; it requires a strategic understanding of the network, the available hardware, and your own individual goals and limitations.

Kaspa, a proof-of-work cryptocurrency known for its blockDAG structure, presents a unique set of challenges and opportunities for miners. Unlike Bitcoin’s SHA-256 algorithm, Kaspa utilizes the kHeavyHash algorithm. This means your trusty Bitcoin ASIC miners are essentially useless here. Forget repurposing old gear; you’re entering a new frontier. The efficiency and profitability of your mining operation will hinge almost entirely on your ability to choose hardware specifically designed for this algorithm.

Considerations abound. Hashrate, power consumption, initial cost, noise levels, and even physical size all play pivotal roles in determining your overall return on investment (ROI). A seemingly powerful miner with a high hashrate might quickly become a liability if its power consumption is astronomical, especially with fluctuating energy prices. Similarly, a cheaper unit with a lower hashrate might offer a more sustainable and profitable approach over the long term. This is where careful calculations and projections come into play.

Venturing beyond the hardware itself, the concept of mining pools enters the equation. Joining a mining pool allows you to combine your computational power with other miners, increasing your chances of solving blocks and earning rewards. However, choosing the right pool is just as critical. Factors to consider include the pool’s fee structure, its historical uptime, and its reputation within the Kaspa community. A lower fee doesn’t always equate to higher profits; stability and reliable payouts are paramount.

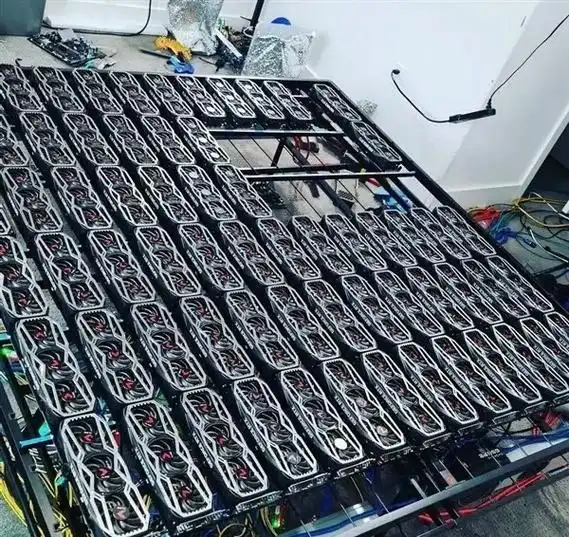

Furthermore, the decision of whether to host your own mining operation or opt for a hosted solution is a significant one. Hosting your own operation grants you complete control over your hardware and environment, but it also entails responsibilities such as managing power, cooling, and security. Mining farm offer professional management, often with lower electricity rates due to bulk purchasing. A well-run mining farm can provide a consistent and stable environment for your miners, minimizing downtime and maximizing potential profits, although hosting fees will cut into your earnings.

Before committing to any specific hardware, it’s wise to conduct thorough research. Read reviews, compare specifications, and consult with experienced Kaspa miners. Online forums and communities are invaluable resources for gathering information and gaining insights from those who have already navigated the intricacies of Kaspa mining hardware selection. Remember, the cryptocurrency landscape is constantly evolving, and new hardware and mining strategies are continually emerging.

Understanding the broader cryptocurrency market is also beneficial, even though you’re focusing on Kaspa. The price of Bitcoin, for example, can indirectly influence the sentiment and activity within the entire crypto space. While Kaspa operates independently, a general market uptrend can boost interest and investment in altcoins, potentially driving up the value of Kaspa and increasing mining profitability. Conversely, a significant downturn in the Bitcoin market could dampen enthusiasm and negatively impact the entire ecosystem.

Similarly, the rise of decentralized exchanges (DEXs) has created new avenues for trading and liquidity within the cryptocurrency market. These platforms often list smaller altcoins like Kaspa before centralized exchanges, providing early adopters with opportunities to trade and participate in the network’s growth. Understanding the dynamics of DEXs can be advantageous for both buying and selling Kaspa, as well as accessing information about new projects and developments.

Finally, remember that cryptocurrency mining, while potentially profitable, is not without its risks. Market volatility, regulatory changes, and technological advancements can all impact your mining operation’s success. Approach Kaspa mining with a long-term perspective, and be prepared to adapt your strategies as the landscape evolves. Thorough research, careful planning, and a commitment to continuous learning are essential for navigating the complexities of Kaspa mining hardware selection and achieving sustainable profitability. The path to profit is paved with knowledge, diligence, and a strategic approach to choosing the right tools for the job.

Leave a Reply