In the rapidly evolving world of cryptocurrencies, choosing the right Bitcoin miner isn’t simply about snagging the latest model off the shelf. Efficiency drives profitability, and decoding Bitcoin miner efficiency has become a pivotal skill for investors, hobbyists, and large-scale mining farms alike. This ultimate buyer’s guide delves into understanding what makes a mining machine truly efficient, the nuances of hosting these rigs, and how this relates to the broader ecosystem of BTC, ETH, DOGE, and other digital currencies.

At the heart of mining efficiency lies the hash rate: the speed at which a mining rig can solve complex cryptographic puzzles to validate transactions and secure the blockchain. Higher hash rates translate into a greater chance of uncovering a new block and earning rewards. But raw power consumes electricity—often the largest operational cost—so a miner’s energy consumption per terahash (J/TH) remains the golden metric. Buyers must weigh the upfront cost of the mining rig against ongoing energy expenditures to determine the real-world ROI.

Advanced ASIC miners designed specifically for Bitcoin mining (BTC) boast cutting-edge chips that maximize hash rates while consuming less power than ever before. For instance, the latest Antminer S19 series exemplifies this balance with hash rates exceeding 95 TH/s and energy consumption as low as 29.5 J/TH. This enables serious miners to stretch profits in an environment of fluctuating Bitcoin prices and escalating network difficulties.

But what about Ethereum (ETH) or Dogecoin (DOGE) miners? While Bitcoin remains the original and most popular cryptocurrency mined with ASICs, Ethereum mining historically relies on GPUs that excel in parallel processing. However, this landscape is changing with Ethereum’s transition to proof-of-stake, reducing traditional mining demand. Dogecoin mining shares similarities with Litecoin, often mined jointly using Scrypt algorithms, and many miners leverage the possibility of merged mining to optimize returns across both coins.

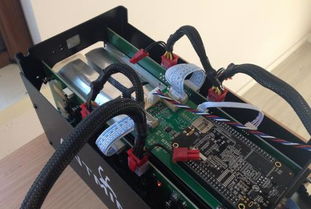

Mining farms—vast complexes filled with hundreds or thousands of mining rigs—embody industrial-scale mining. Here, the efficiency equation incorporates not just the miner’s specs but also cooling solutions, electrical infrastructure, and hosting arrangements. Hosting companies provide miners a secure, climate-controlled environment, often paired with preferential electricity rates. This arrangement removes the headaches of home mining, including heat management and power supply stability, enabling participants to focus on strategy rather than logistics.

When selecting hosting services, it’s crucial to verify uptime guarantees, security protocols, and fee structures. Some providers bundle maintenance and firmware updates, relieving miners of technical burdens. Savvy buyers also look for flexibility—can they upgrade rigs quickly, or switch between hosting providers? The dynamic crypto market rewards agility, and hosting options need to be part of that calculus.

Exchanges enter the scene not only as platforms trading cryptocurrencies but also as ecosystems influencing mining profitability. Mining pools connected to exchanges offer payouts in Bitcoin, Ethereum, or other tokens, smoothing variance in earnings. Moreover, some exchanges now offer staking and DeFi services, expanding revenue possibilities beyond traditional mining.

As the mining landscape matures, a few unexpected trends emerge. One is the commoditization of secondhand mining rigs, which may be attractive to budget-conscious buyers but come with trade-offs in energy efficiency and warranty coverage. Another is the rise of eco-conscious mining initiatives leveraging renewable energy, where the efficiency debate crosses into sustainability. A Bitcoin miner powered by hydroelectricity or solar doesn’t just cut costs—it bolsters crypto’s image in an increasingly green-aware world.

In this vibrant mosaic, understanding the interplay of miner specifications, hosting environments, network dynamics, and market flux is no longer optional. Decoding Bitcoin miner efficiency means navigating technical jargon, financial metrics, and operational considerations. The ultimate buyer’s guide advocates a holistic viewpoint: prioritize machines that align hash rate with energy conservation, choose hosting solutions offering robust support, and remain nimble to leverage emerging trends across Bitcoin, Ethereum, Dogecoin, and beyond.

Finally, seasoned miners keep an eye on software optimizations and firmware improvements, which can squeeze extra performance from existing hardware. The mining rig is only as good as its ecosystem of updates, patching security vulnerabilities, optimizing power draw, and adapting to protocol shifts. Investing in a miner without considering ongoing software support would be a glaring oversight—profitability hinges as much on evolving technology as on initial hardware strength.

In conclusion, the buyer stepping into the world of cryptocurrency mining must become a connoisseur of complexity. Bitcoin’s pioneering spirit birthed an entire industry where mining rigs buzz tirelessly across continents, chips hum in unison to verify blocks, and investors parse energy bills against volatile digital assets. Decoding miner efficiency unlocks the door to this high-stakes game where every joule and hash counts, guiding buyers toward choices that feed both their wallets and the blockchain’s unstoppable march forward.

Leave a Reply