The world of cryptocurrency mining, with its complex algorithms and specialized hardware, has always operated on the cutting edge of finance and technology. However, the traditional financial accounting landscape has often struggled to keep pace with this rapidly evolving industry. Enter the Financial Accounting Standards Board (FASB), a private, non-profit organization responsible for establishing generally accepted accounting principles (GAAP) in the United States. Their pronouncements can significantly impact how crypto mining operations, particularly those heavily invested in mining rigs, manage their financial records.

Understanding FASB’s evolving stance on digital assets is crucial for any mining operation aiming for transparency and compliance. For years, the lack of specific guidance led to inconsistent reporting practices, making it difficult to compare the financial performance of different mining companies. This uncertainty also complicated tax reporting and audits. While the details of FASB’s guidance are constantly being refined, the core principle remains the same: accurate and transparent financial reporting.

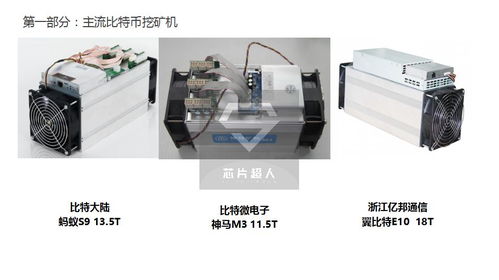

At the heart of many crypto mining operations lies the mining rig – a powerful and often expensive piece of equipment. The treatment of these rigs on the balance sheet has been a point of contention. Under previous accounting practices, many companies were writing down the value of their crypto holdings, including those generated by mining, to fair value at the end of each reporting period, with losses recognized in the income statement. This approach often resulted in volatile earnings, particularly during periods of significant price fluctuations in the cryptocurrency market. However, the FASB’s updated guidelines aim to address this issue, potentially allowing for a more stable and accurate reflection of the value generated through mining activities.

The new guidelines introduced by FASB offer some relief, particularly regarding the accounting for crypto holdings. Now, companies may be able to measure certain crypto assets at fair value, but with changes recognized in comprehensive income rather than net income. This means that unrealized gains and losses on crypto holdings will not directly impact the company’s reported earnings, reducing volatility and providing a clearer picture of the underlying business performance. This change is particularly beneficial for miners who hold onto mined coins, hoping for future appreciation. For example, a miner accumulating Bitcoin (BTC) or Ethereum (ETH) would see less earnings volatility under the new rules.

Furthermore, the cost of electricity, maintenance, and other operational expenses directly related to running mining rigs are typically expensed as incurred. This is a standard accounting practice and is unlikely to be significantly impacted by FASB’s new guidance. However, careful tracking of these expenses is essential for accurate cost accounting and profitability analysis. Factors like energy consumption, hardware depreciation, and pool fees all contribute to the overall cost of mining and must be meticulously documented.

Mining pools also play a significant role in the financial operations of many miners. These pools combine the computational power of multiple miners to increase the likelihood of solving a block and earning a reward. The accounting for pool fees and revenue sharing can be complex, particularly when dealing with different types of cryptocurrencies and payout structures. Consistent and transparent accounting practices are crucial for ensuring accurate reporting of income and expenses related to pool participation.

Beyond Bitcoin and Ethereum, many miners are exploring alternative cryptocurrencies like Dogecoin (DOGE) or other emerging coins. The accounting treatment for these altcoins is generally the same as for Bitcoin and Ethereum, but the volatility and liquidity of these assets can present additional challenges. It’s essential to have a clear and consistent valuation methodology for all crypto assets held, regardless of their market capitalization.

The implications extend to mining machine hosting services. These services provide infrastructure and support for miners who prefer not to manage their own hardware. The accounting for these services can be complex, involving considerations such as revenue recognition, cost of services, and depreciation of infrastructure assets. Companies offering hosting services must adhere to GAAP principles and ensure transparent reporting of their financial performance.

Properly accounting for depreciation on mining rigs is another critical aspect. Mining rigs are subject to wear and tear and will eventually become obsolete. The depreciation method used should reflect the expected useful life of the equipment and the pattern in which its economic benefits are consumed. Consistent application of a depreciation method ensures comparability across reporting periods and provides a more accurate picture of the company’s financial position. This could involve using straight-line depreciation or, in some cases, accelerated depreciation methods to reflect the rapid technological advancements in the mining hardware space.

Navigating the complexities of FASB regulations requires a deep understanding of both accounting principles and the intricacies of the cryptocurrency mining industry. Seeking guidance from experienced accounting professionals is essential for ensuring compliance and maintaining accurate financial records. As the regulatory landscape continues to evolve, staying informed and adaptable will be crucial for success in the ever-changing world of crypto mining.

Furthermore, the choice of exchange where mined coins are traded can also have accounting implications. Different exchanges may have different fee structures and reporting requirements. It’s essential to select exchanges that provide accurate and reliable transaction data for accounting purposes. Miners should also be aware of any tax implications associated with trading on different exchanges.

Ultimately, understanding and implementing FASB’s guidance is not just about compliance; it’s about building trust and credibility within the cryptocurrency industry. By embracing transparency and accountability, mining operations can attract investment, build strong relationships with stakeholders, and contribute to the long-term growth and stability of the digital asset ecosystem.

Leave a Reply to FTX Cancel reply